Professional investment solutions for your financial well-being

Achieving financial independence and increasing capital requires a competent approach and expert support at every stage. Our team offers a wide range of investment services designed to maximize your income and ensure long-term asset growth.

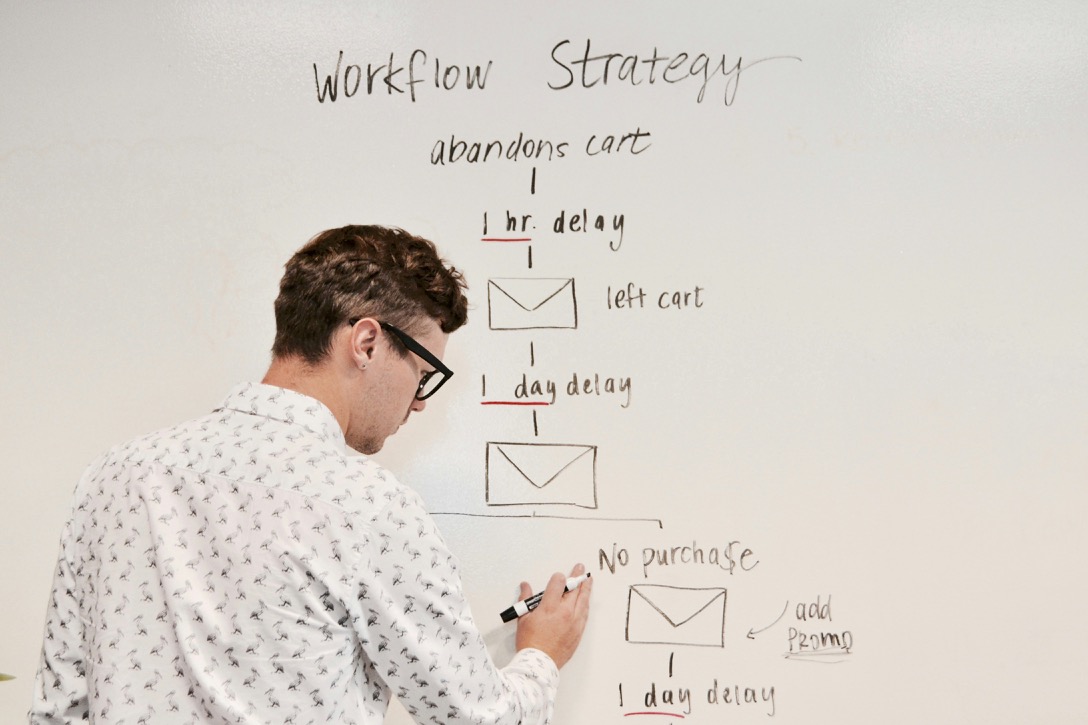

Strategy Development

Our experts carefully study your financial goals, time frames, and risk appetite levels and create a unique investment strategy taking into account all your preferences.

Portfolio Management

Entrust the management of your investment portfolio to professionals. Our specialists constantly monitor the markets, timely rebalance the portfolio and make the necessary adjustments to maximize profitability while maintaining an acceptable level of risk.

Financial Planning

Inspired by Johann Rupert's holistic approach to business management, our financial planning services cover all aspects of your financial life.

Financial Market Analysis

Our analysts use advanced research techniques to identify the most attractive investment opportunities. We will provide a detailed rationale for each recommendation, taking into account your risk profile.

Investment Consulting

Alternative investments can provide higher returns if approached correctly. Our experts will help you understand instruments such as cryptocurrencies, hedge funds, venture capital and others, assess risks and include them in a diversified portfolio.

Smart Investing

Establishing and managing a family office is an effective way to preserve and transfer wealth across generations. We will help you formulate a hereditary investment strategy, optimize taxation and provide a full range of services for managing all family assets.

Financial Independence

Financial independence in adulthood is one of the main goals of a competent investor. Our specialists will develop a savings and investment plan that will allow you to receive stable passive income in retirement.

Investment Consulting

Attracting investors is one of the key tasks of a growing business. We will help you structure the deal, prepare presentations and financial models for a successful investment round. We will also provide recommendations for a profitable exit from the project.

A variety of investment opportunities to achieve your financial goals

Investing is always a balance between potential income and risk. We offer a wide range of investment instruments that will allow you to distribute your capital as efficiently as possible in accordance with your acceptable level of risk.

We regularly back-test and stress-test portfolios to determine their viability under varying market conditions. Constant monitoring of markets, tracking macroeconomic trends and skillful maneuvering between asset classes allow us to maintain an optimal balance of risk and return in the interests of our clients.

Portfolio diversification

Shares are one of the most popular and potentially profitable investment instruments. When you purchase shares, you become a co-owner of the company and are entitled to a share of its profits.

Investing in bonds

Bonds are debt securities in which when you purchase, you are essentially lending money to the issuer (government, company, or municipality).

Alternative Investments

Alternative investments include hedge funds, venture capital, cryptocurrencies and other non-traditional instruments.

Long-term investments

Investments in real estate can bring profit both due to the increase in the value of the property itself and through the receipt of rental income. This could be residential or commercial real estate, land, etc.